Taxpayer’s Guide to IRS Form 433-F

Collection Information Statement

The IRS uses Form 433-F (Collection Information Statement) to develop an in-depth understanding of a taxpayer’s financial situation. This form helps the IRS to determine your eligibility for different types of payment plans. To obtain the best terms possible for your payment plan, you need to ensure that you fill out this form correctly.

Our tax attorneys have extensive experience negotiating with the IRS. We can help you deal with IRS Form 433-F — To get help, contact us at the W Tax Group today.

Key takeaways

- Form 433-F is a collection information statement.

- The IRS uses this form to collect information about your finances to see how much you can afford to pay.

- You may need to file Form 433-F if you want to set up a payment plan and you owe over a certain amount or cannot afford the minimum payment.

- Revenue officers may request this form, regardless of how much you owe or if you have a history of default.

- You can mail this form to the IRS or call with the info.

When Do You Need to File Form 433-F?

The IRS often requires Form 433-F if you request a payment plan on your tax liability. Here are the situations where you need to complete Form 433-F when applying for a payment plan:

- If you’re applying for a non-streamlined payment plan on a total balance of over $50,000, including penalties and interest.

- A revenue officer requires a Collection Information Statement; they may require one regardless of how much you owe.

- If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years).

- If you owe more than $25,000 but less than $50,000 and you don’t want to set up direct debit for your payment plan.

While the IRS may be more likely to require a Collection Information Statement if you owe a substantial amount of debt, this doesn’t mean that you are automatically safe from this requirement if your total balance is low. They may require one in any case they deem necessary. For example, if you have defaulted on a payment plan in the last two years, the IRS may request this form before letting you set up a new installment agreement.

You may also need to complete Form 433-F if you want to obtain hardship status from the IRS. The IRS will let you know if you need to file this form.

How to Complete IRS Form 433-F

To complete Form 433-F, you start with basic information, including:

- Your Social Security Number

- Name and address

- Phone number, including all phone numbers you can be reached at

- Spouse’s information if applicable

If filing this form for a business, you need the business name, Employer Identification Number (EIN), type of business, and number of employees. Then, you provide information about your assets, liabilities, income, and expenses.

Here are tips on how to complete each section of Form 433-F. If you have additional information that doesn’t fit into the form, you will need to use additional sheets if necessary. When attaching additional sheets, ensure the IRS can easily match the information to the correct section of the form.

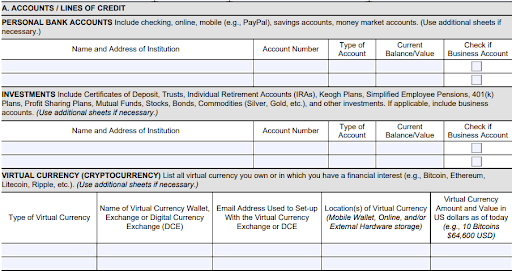

A. Accounts/Lines of Credit

- Enter all of your accounts and lines of credit followed by their balances. Make sure to list all accounts even if they don’t have a balance. This includes:

Bank accounts - Certificates of deposits (CDs)

- Retirement accounts

- Cryptocurrency accounts.

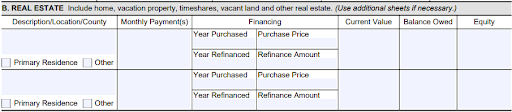

B. Real Estate

List all of your real estate including your primary residence. Required information includes:

- The monthly payment

- The year purchased

- he purchase price

If you’ve refinanced, you also need to note the year and refinance amount. Then, note the current value, the amount owed, and the equity in the property. The property’s equity is the difference between what you owe and the property’s value.

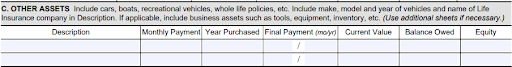

C. Other Assets

Other assets may include:

- Cars

- Boats

- Recreational vehicles

- Whole life insurance policies

- Coin collections

- Paintings

- Antiques

- Intangible assets

- Anything you own of value

Provide a description of these assets, the monthly payment, the year of purchase, and the date of your final payment. Then, note the current value, balance owed, and equity.

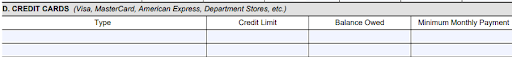

D. Credit Cards

List all of your credit cards along with the minimum monthly payment, the credit limit, and the balance on the account. Make sure to include all accounts even if they don’t have a balance or you don’t use them.

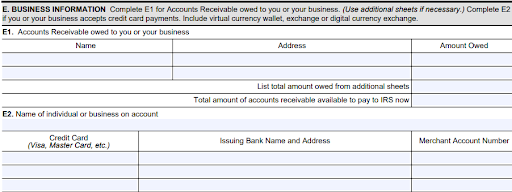

E. Business Information

You should complete this section if you or your spouse are self-employed or small business sole proprietors. In the accounts receivables section, simply detail the amounts that your clients owe you. You will need their name, address, and amount owed. If you accept credit cards, you also need to note your merchant account number and other details.

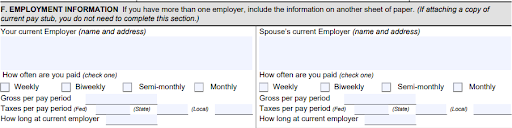

F. Employment Information

In this section, you need to note:

- How often you’re paid

- The gross pay per pay period

- The taxes per pay period

- How long you’ve been with your employer

Provide these details for both you and your spouse.

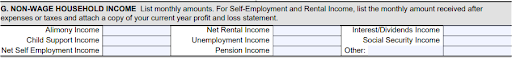

G. Non-Wage Household Income

In section G of Form 433-F, you need to note all other household income. This includes:

- Alimony

- Child support

- Unemployment income

- Pensions

- Interest

- Dividend income

- Social Security payments

You also need to note self-employment and rental income. In these categories, use net income, which is your income after expenses. To back up self-employment income and expenses, you need to provide a copy of Schedule C from your tax return or a current profit-and-loss statement. For rental income, you should include a copy of Schedule E. When calculating your net income, do not take depreciation into account. You should only include expenses that directly affect your cash flow.

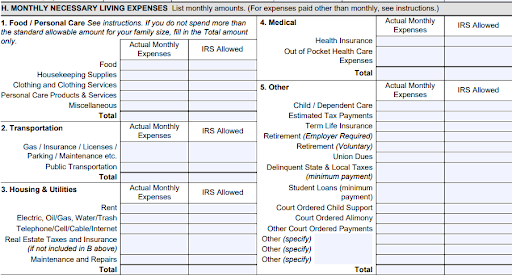

H. Monthly Necessary Living Expenses

In section H, you need to list all of your monthly expenses including:

- Food

- Personal care

- Transportation

- Housing

- Utilities

- Medical expenses

- Child care

- Child support

- Student loans

- Court-ordered payments

- Other expenses

You should note the expense as well as the IRS’s allowance.

The IRS has a set of Collection Financial Standards that outline how much the agency thinks people should spend in various expense categories based on where they live. In most cases, the IRS will only take into account expenses that are at or below the standard, but in some cases, the agency lets you claim the allowed amount even if you spend less.

For instance, as of 2024, the IRS thinks that three-person families should spend $977 per month on food. If you spend over that amount, the IRS won’t take into account the excess when assessing your ability to pay your taxes. If your expenses do exceed the allowed standards, you should expect the IRS to disallow the excess. However, if you have a good reason for the excess spending such as a health condition that requires a certain diet, you can provide documentation supporting your case.

In addition to national standards, the IRS uses local standards for some categories. You’ll need to look into housing and utilities standards for your state and county. There are also local standards for transportation.

Note that the IRS financial standards apply to monthly bills. If you have bills that aren’t paid monthly, you will need to convert them to a monthly amount. For quarterly bills, you should divide by three. For weekly bills, multiply by 4.3. For biweekly bills, multiply by 2.17. For semi-monthly bills, multiply by two.

Out-of-pocket medical expenses are also accounted for in IRS calculations. These expenses include medical services, medical supplies, and prescription drugs, but they do not include health insurance premiums.

As of 2024, those who are under 65 can claim up to $83 in out-of-pocket expenses each month. Those older than 65 can claim up to $158. This is often a category where people need to overspend, and if so, you will need to provide the IRS with additional supporting documents such as doctor’s bills or notes. However, if your expenses are below this threshold, you can still claim the full allowed amount as part of your necessary monthly spending.

Where to Mail IRS Form 433-F

The mailing address for Form 433-F varies depending on where you live. Typically, you submit this form when you file Form 9465 (Installment Agreement Request). If you’re submitting Form 9465 by itself, send it along with Form 433-F and any other required information to the address in the Form 9465 instructions.

Do not forget to include supporting documents–the IRS will either reject your application or request your supporting documentation if you fail to do so. Either way, this results in avoidable delays. Send your form via certified mail so you have proof of when it arrives at the IRS office.

If desired, you can also submit a request for a payment plan when you file your taxes. In this case, you should attach these documents to your tax return, and you should mail everything to the address noted in your 1040 instruction booklet.

Phone Submission

If you would rather submit via phone, you can call the IRS directly to talk to an agent. They may ask you to submit your documentation and forms via fax, which you can typically do via a physical fax machine or a phone app that scans and faxes your documents. The main benefit of this option is receiving immediate feedback on your documentation and setting up a payment plan right away if approved.

Options for Resolving Tax Liability After Submitting Form 433-F

The payment options available to you depend on how much you owe, what your documentation and Collection Information Statement show that you can afford, and other factors. You may request an installment agreement, which allows you to make payments for up to 72 months to pay off your tax debt. Other potential options include an offer in compromise or a partial payment installment agreement.

It’s important to note that different payment options may require different Collection Information Statements, so you’ll need to verify that you’re submitting the correct one for the relief you are requesting.

Other IRS 433 Forms

Form 433-F is not the only form in this series. The IRS also uses Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) and Form 433-B (Collection Information Statement for Businesses). These forms request a lot more detail than Form 433-F.

If you request a Partial Payment Installment Agreement, the IRS will typically require you to submit Forms 433-A and/or 433-B. For an Offer in Compromise, the agency will ask for Forms 433-A (OIC) or 433-B (OIC).

Differences Between Form 433-F and Form 433-A

Form 433-F is the streamlined Collection Information Statement, so you’ll need less time and supporting documentation to complete it. It’s just two pages long and is typically reserved for simple cases.

However, some taxpayers will need to submit Form 433-A or 433-A (OIC) to have their relief request considered. These forms are considerably more detailed than Form 433-F, requiring extensive financial information and documentation backing up every single aspect of your financial status. The more complex your tax case is, the more likely it is that you will have to submit Form 433-A.

Get Help With Form 433-F

Wondering if it’s time to talk to a tax professional about filling out Form 433-F? There are several instances where you may save time, energy, and stress by talking to a tax pro. If you’re struggling to come up with a payment plan that fits your budget and allows you to address your tax debt, a tax professional can help you better understand your options.

You may also want to talk to a tax attorney if you’re uncertain about whether you need to submit Form 433-F or Form 433-A. You should also reach out to a tax pro if you’re trying to complete these forms but your expenses are higher than the allowed amounts. Communicating with the IRS can be stressful; your tax attorney can handle communication on your behalf and negotiate for a payment arrangement that suits you.

If you need help filing Form 433-F, requesting a payment plan, or negotiating other arrangements with the IRS, we can help. At the W Tax Group, we specialize in helping people resolve their IRS and state tax problems. To learn more and to talk about the best options for your situation, contact us today.