Form 433 D: Instructions and Tips for Taxpayers

If you get approved for an installment agreement, the Internal Revenue Service will send you Form 433-D (Installment Agreement). This form outlines your monthly payments, and when you sign it, you agree to the terms of your installment agreement. You also use this form to set up direct debits so that the IRS can take your monthly payments out of your bank account.

To help you out, this guide explains how to complete Form 433-D, and it provides a brief overview of what to expect with this form.

Want to get help right now? Then, contact us immediately. At the W Tax Group, our attorneys are committed to providing our clients with high-quality personalized attention. We can help you deal with IRS and state tax problems.

What Is IRS Form 433-D?

Form 433-D is the form the Internal Revenue Service uses to finalize installment agreements and collect direct debit payment information from taxpayers. It shows the amount of your initial payment plus the date and amount of your regular monthly payment. It also includes the date and amount of any planned increases or decreases to your payments.

Who Needs to File IRS Form 433-D?

The IRS will let you know if you need to file Form 433-D. This form comes into play when a taxpayer qualifies for an installment agreement. The IRS uses this form to get your bank account information for a direct debit installment agreement (DDIA).

Even if you’re not paying by direct debit from your bank account, you will have to sign this form to show that you agree with the terms of the payment plan. You may also need to fill out Form 433-D if you want to make changes to an existing installment agreement or if you defaulted and need to reinstate an agreement.

If you set up a payment plan online, you may not need to complete this form. Instead, you will just provide your bank account details at some point during the online application process.

How to Complete Form 433-D

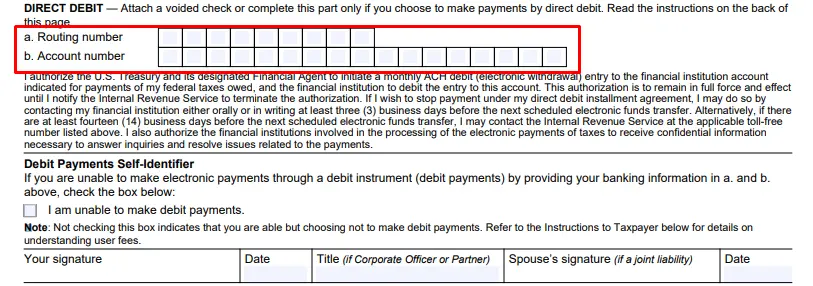

In some cases, the IRS may complete this form on your behalf. It will be filled out with your contact information, tax debt numbers, and payment details. You simply need to provide your bank routing and account numbers to set up the direct debit.

If you receive a blank 433-D Installment Agreement, you need the following information to complete it:

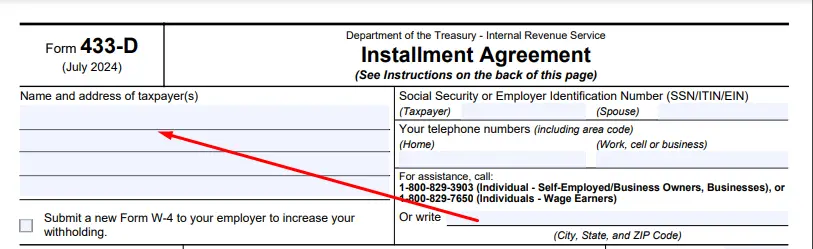

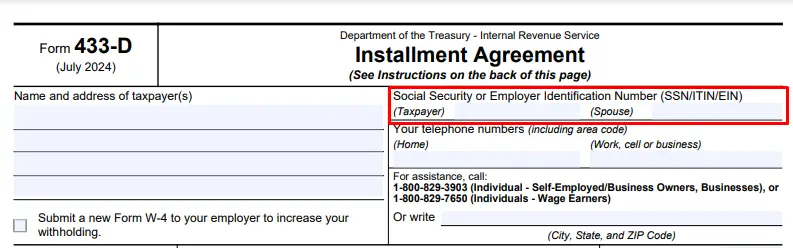

Your name and address of taxpayer/taxpayers

An address that the IRS can match to you is best, match your last filed tax return.

Social Security Number (SSN) for individual taxpayers or Employer Identification Number (EIN) for businesses

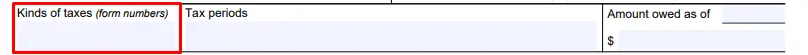

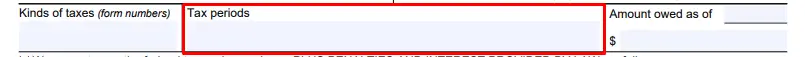

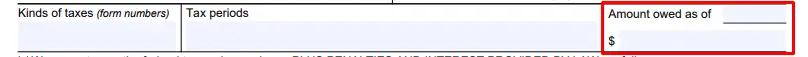

Kinds of Taxes

Note the form number for the tax return you filed. For instance, if your installment agreement is for personal income taxes, write 1040.

Tax periods

Note the tax years related to the tax debts you’re making payments on. For business taxes, this may be quarterly or monthly time periods.

Amount owed

This is the total of your tax debt, interest, and penalties. Because interest is constantly accruing, you also need to note the date that you owed this balance.

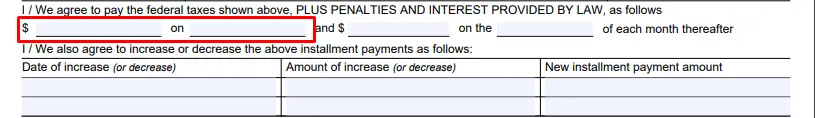

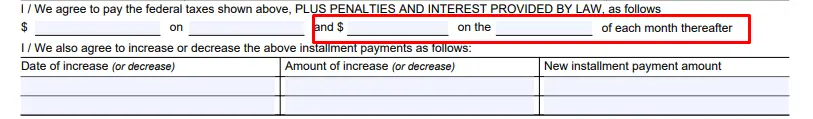

The amount of your initial payment

This is often higher than the regular monthly payments to cover the installment agreement application fee.

The amount of and date of your monthly payments.

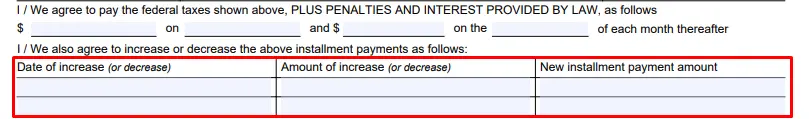

Future Increases or decreases to monthly payments

If applicable, future increases or decreases to your payments. For instance, if your employer is giving you a raise in three months, you might schedule your payments to increase at that time. You can note multiple increases or decreases on Form 433-D.

The routing number and account number for the direct debit payment

You can get this from a voided check.

You don’t need to fill out the bottom of the form. This part is for the IRS. This is where the IRS agent notes whether or not to review your file in two years. If you set up a standard installment agreement, there will not be a two-year review, but if you set up a partial payment installment agreement, there will be a two-year review. The IRS also notes if there are any levies against your assets in this section.

The Direct Debit Section on Form 433-D

If you cannot set up direct debit, you can note that on the form. Then, you can mail in your monthly payments. Generally, you’re only required to set up a direct debit installment agreement if you owe more than $25,000.

If you owe over that threshold and can’t set up direct debit or payroll withdrawals, the IRS will require you to file Form 433-F. This form collects detailed information about your finances. Usually, however, this requirement comes up before you reach this stage of the process.

Where to Mail Form 433-D

When you receive IRS Form 433-D, it will come with a letter that tells you where to mail the form. If you lost the letter and you’re not sure where to send the form, call the IRS directly or contact a tax professional to help you.

Talk with the IRS to ensure you’re using the right address. Alternatively, you can use the following mailing addresses which are also where the IRS has you send Form 9465 if you’re applying for a payment plan through the mail but not at the same time as you’re filing a tax return:

If you live in AL, FL, GA, KY, LA, MS, NC, SC, TX, or VA:

Department of the Treasury

Internal Revenue Service

P.O. Box 47421 Stop 74

Doraville, GA 30362

If you live in AK, AZ, CO, CT, DE, DC, HI, ID, IL, ME, MD, MA, MT, NV, NH, NJ, NM, ND, OR, RI, SD, TN, UT, WA, WI, or WY:

Department of the Treasury

Internal Revenue Service

310 Lowell St. Stop 830

Andover, MA 01810

If you live in AR, CA, IN, IA, KS, MI, MN, MO, NE, NY, OH, OK, PA, or WV:

Department of the Treasury

Internal Revenue Service

Stop P-4 5000

Kansas City, MO 64999-0250

If you live out of the country or use an APO or FPO address:

Department of the Treasury

Internal Revenue Service

3651 South I-H 35, 5501AUSC

Austin, TX 78741

The IRS has multiple addresses. It’s important to use the right one to ensure that your information doesn’t get lost and that you don’t receive processing delays.

IRS Form 433-D Installment Agreement Terms

By signing IRS Form 433-D, you agree to the terms of your IRS installment agreement. These terms are active for the duration of the agreement. Here are the terms that are outlined on Form 433-D:

- You must file and pay all federal taxes on time.

- The IRS will keep your tax refunds and apply them to your tax debt.

- If you miss a monthly payment, the IRS can terminate your agreement.

- The IRS can file a tax lien against you even though you’re making payments.

- The IRS can rescind the agreement if the tax collection appears to be in jeopardy.

- You must pay a $178 fee for the installment agreement. This drops to $107 if you set up a direct debit installment agreement. It’s only $43 for low-income taxpayers, and it’s free for low-income taxpayers who set up a direct debit installment agreement.

- Your first payment will be the amount of your set-up fee or your regular monthly payment, whichever is higher.

- If you default and the IRS agrees to let you resume payments, you agree to pay an $89 reinstatement fee. It’s only $43 for low-income taxpayers, but it can be waived if you’re low-income and set up direct debits.

Before setting up an installment agreement, you should make sure that you can commit to these terms. In some cases, the IRS may require you to fix the issue that got you behind on your taxes. For instance, if your employer wasn’t withholding enough from your paycheck, you may need to increase your withholding to get the payment plan approved.

IRS Form 433 Series

Form 433-D is just one of the forms in the 433 series. This series also includes the following:

- 433-A (Collection Information Statement for Wage Earners and Individuals)

- 433-B (Collection Information Statement for Businesses)

- Form 433-F (Collection Information Statement)

- Form 433-H (Installment Agreement Request and Collection Information Statement).

As you can see, all of the other forms in the 433 series are collection information statements. The IRS uses these forms to collect information on taxpayers’ income, expenses, assets, and debts to determine if they qualify for different types of payment plans or tax relief programs.

Form 433-D Versus Form 9465

IRS Form 9465 (Installment Agreement Request) and Form 433-D (Installment Agreement) have very similar names, but these forms have different functions. As implied by the name, you use Form 9465 to request an installment plan, and you use Form 433-D to finalize your installment agreement.

In most cases, by the time you receive IRS Form 433-D, your installment agreement should be approved. However, that is not always the case. When you sign this form, you also agree that your payment plan may still need to be approved. For instance, the IRS may deny your payment plan if an IRS agent discovers that you didn’t meet the terms outlined in the form.

This can be confusing for many taxpayers. A tax attorney can answer your questions.

FAQs About Form 433-D

What is a direct debit installment agreement?

A DDIA is an installment agreement where you allow the IRs to direct debit the payment automatically from your bank account.

Do you have to complete Form 433-D for short and long-term payment plans?

Generally, you only need to complete Form 433-D if you’re on a long-term payment plan. You don’t need to do direct debits for short-term plans.

Which other forms do you need to set up an installment agreement?

If you owe less than $50,000, you can set up your payment plan online. However, if you owe over that threshold, you will need to file Form 9465 and Form 433-F. Form 433-F is a collection information statement, and you may also need to complete it if you owe less than $50,000 but cannot afford the minimum payment, need longer to pay, or have a history of defaulting on payment plans.

Can I mail Form 9465 and Form 433-D together?

Yes, you can mail these forms to the IRs together, but keep in mind that the IRS may still reject your request at this point,

What are set-up fees?

Set-up fees cover the cost of creating an IRS installment agreement. If you apply online and set up direct debits, you enjoy the lowest setup fee which is just $31. You can avoid this fee completely if your income falls below a certain level.

Get Help With Form 433-D

Have you received IRS form 433 in the mail? Are you wondering what you need to do to complete this form? Are you interested in setting up an installment agreement, but not sure which form to use? Then, you should reach out for help from a tax professional.

The tax attorneys at the W Tax Group can help you set up a payment plan for personal or business taxes including delinquent employment taxes in some cases. If you don’t qualify for a payment plan, we can help you find other options. To learn more, contact us today. We’ll start with a free consultation and help you find the best relief options for your tax problems.