Form 433-B (Collection Information Statement for Businesses)

How to Complete When Applying for Business Payment Plans or Tax Settlements

Key takeaways

- Form 433-B – Required for in-operation businesses that want to set up payments or apply for settlements on business taxes.

- Two versions – Use the 433-B for payment plans and 433-B (OIC) for offer in compromise.

- How to complete – Fill out with information about the business, its owners, its assets, debts, income, and expenses.

- What if you don’t complete correctly – The IRS may deny your request for payments and pursue involuntary collections.

- Why get help – To ensure you’re applying for the right type of relief and to negotiate with the IRS.

Form 433-B is a collection information statement for businesses. Complete these versions of the form in the following situations:

- Form 433-B – If your business is applying for an installment agreement on over $25,000 in taxes or needs more than two years to pay.

- Form 433-B (OIC) – If your business is applying for an offer in compromise.

This post explains how to fill out these tax relief forms. To get help with business tax problems, contact us at the W Tax Group today.

Table of Contents

- Why the IRS requires Form 433-B

- Pre-qualification requirements for businesses

- How to complete Form 433-B

- Which supporting documents should be attached

- What happens if you make mistakes on Form 433-B

- Tips for success

- FAQs

- How to get help with business back taxes

Why the IRS Requests Form 433-B

Form 433-B tells the IRS about your business’s assets and average gross monthly income. The IRS uses this information to decide if you qualify for a payment plan or a tax settlement. You may also need to fill out this form if your business needs to temporarily delay paying taxes.

Only use this form if your business is a c-corp, s-corp, or partnership. If your business is a sole proprietorship that files taxes on a Schedule C, you should typically file Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) or Form 433-F.

Pre-Qualification Requirements for Form 433-B

Generally, the IRS will not approve a payment plan or an offer in compromise for your business unless you meet these requirements:

- Not in a bankruptcy proceeding.

- Made federal tax deposits for the last two quarters.

In some cases, you may need to meet additional requirements. For instance, the IRS generally won’t allow businesses to make payments on more than $25,000 in back taxes unless the business is no longer operating – but there are exceptions to that rule.

How to Fill Out IRS Form 433-B

This form requests detailed information about your business assets, debts, monthly income, and expenses. Keep reading for tips on how to complete this form.

Make sure you’re using the correct version of the form

There are two different versions of this form.

- If you’re applying to settle your business taxes, use Form 433B (OIC).

- Use Form 433-B if you’re applying for a payment plan.

Note that if you owe less than $25,000, can pay off the balance in two years, and have a history of compliance, you can generally set up an in-operation express payment plan on business taxes without filing this form.

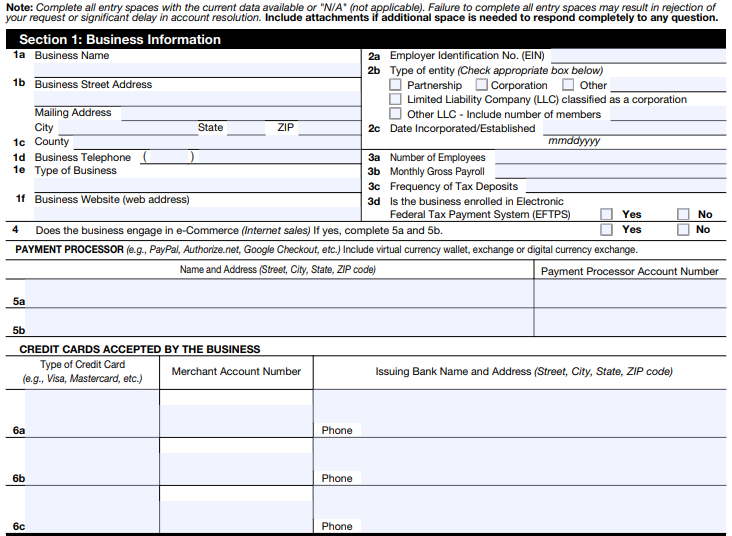

Section 1: Basic Business Information

Both 433-B and 433-B (OIC) request basic information about your business, including:

- Business name, address, phone number, and website.

- EIN – employer identification number

- Type of entity – partnership, LLC, corporation, etc.

- Number of employees and monthly gross payroll

- If you’re enrolled in the EFTPS

- Frequency of tax deposits

- Payment processor – for instance, PayPal or Square

- Credit cards you accept and merchant account numbers

On the 433-B (OIC), you also note details about partners, officers, LLC members, and major shareholders in section one.

Section Two: Business Personnel and Contacts

The form wants these details about your partners, officers, or major shareholders: name, address, taxpayer ID number, phone number, annual salary or owner’s draws, and percentage of ownership.

Note that section two of Form 433-B (OIC) is focused on business assets, just like section four outlined below.

Section Three: Other Financial Information

Section three of Form 433-B and section six of Form 433-B (OIC) ask the following questions about your business:

- Do you use a payroll services provider?

- Are you party to a lawsuit? If so, what is the amount of the suit?

- Has the business filed for bankruptcy in the last 10 years?

- Do any related parties owe money to the business?

- Has the business transferred any assets for less than full value in the last 10 years?

- Does the business have subsidiaries, parent companies, or other business affiliations?

If you’re filling out the 433-B (OIC), the form asks the following additional questions:

- Has the business been involved in litigation with the IRS or the United States?

- Has the business transferred any real property in the last three years?

- Has the business operated outside of the United States for more than six months in the last 10 years?

- Does the business have any assets or real property outside of the United States?

- Are there any funds held in a trust by a third party?

- Are there business lines of credit? Are they secured by property?

- Have you experienced an increase or decrease in anticipated income?

- Are you a federal contractor?

Section Four: Business Asset Information

Both versions of Form 433-B require detailed information about your business assets. This is section four of the 433-B and section two of the 433-B (OIC). Both forms request very similar information, but the OIC form requires you to do an additional calculation where you multiply fair market value of the asset by 0.8 and then subtract the loan balance. This helps the IRS determine how much equity you have to put toward your settlement offer.

Make sure you have the following details about your business assets so that you can fill out the form correctly:

- Cash on hand.

- Cash and other contents in on-premise safes.

- Business bank accounts and balances.

- Details about accounts receivables.

- Investment accounts including stocks, bonds, mutual funds, virtual currency, etc.

- Real property and vehicles — purchase date, fair market value, loan balance, monthly payments, date of final payment, and equity.

- Business equipment.

- Intangible assets.

The 433-B form also asks about your business liabilities and your total available credit.

Section Five: Business Income and Expenses

Form 433-B asks for details about business expenses and income in section five. On the 433-B (OIC), section three is for business income information, while section four is for business expense information.

On the 433-B, you can detail your business income and expenses from the last three, six, nine, or 12-month period. On Form 433-B (OIC), you can use the last six or 12-month period. Alternatively, with the OIC form, you can attach a current profit and loss statement covering the last six or 12 months, and then, note your total income and expenses on the form.

Both forms require the following details about your business income:

- Gross receipts

- Gross rental income

- Interest income

- Dividends

- Cash receipts

- Other income

Here is what you need to note about your business expenses:

- Materials or supplies

- Inventory purchased

- Gross wages and salaries for business personnel

- Rent

- Supplies

- Monthly payments for utilities/telephone

- Vehicle expenses including gasoline, repairs, and maintenance

- Insurance

- Current taxes such as quarterly payments and payroll taxes

- Other expenses

At this point, you are done with IRS Form 433-B. All you need to do is sign, seal, deliver, and then, wait for a response. But if you’re filling out Form 433-B (OIC), you have one more section to complete.

Section Five of Form 433-B (OIC): Calculating Your Minimum Offer

To complete Form 433-B (OIC), you need to calculate your minimum offer. There are two calculation methods to determine your minimum offer amount. Both start with the equity in your business assets. Then, you add on your business’s future earning potential, but the amount you include depends on how long you need to pay the settlement.

If you can pay the settlement in five months, you multiply your disposable income by 12. If you need up to 24 months to pay the settlement, multiply your disposable income by 24. Your disposable income is the difference between your business income and expenses.

Note that the IRS does not accept every offer. If the IRS believes that you can pay your tax debt in full by selling assets, cashing out investment accounts, or taking out a loan, the agency may reject your offer and demand full payment.

This is when a tax attorney can be critical. They understand how to convince the IRS to decrease the minimum offer, and they also know how to explain to the IRS that you can’t necessarily liquidate your business equipment, especially income-producing assets. In fact, if you structure the offer correctly, the IRS shouldn’t take into account the equity in income-producing assets. That can save you a lot of money.

Supporting Documents for IRS Form 433-B

Include the following supporting documents:

- P&L statement showing the last six to 12 months.

- Copies of the last six months of bank statements.

- Copies of loan statements, loan payoffs, and balances.

- Details on which loans are secured by business assets.

- Documents to support any special circumstances.

- A completed copy of Form 656 if you’re applying for an Offer in Compromise.

What If You Make Mistakes on Form 433-B?

Errors can prevent you from getting approved for a payment plan or an offer. If the IRS believes that you can pay in full or thinks that you can no longer operate a business and stay compliant with tax obligations, the agency may move forward with tax liens, bank levies, and asset seizure.

Tips for Sucess With Form 433-B

Keep these tips in mind as you complete this form:

- Fill out the form completely – If you don’t complete the form, the IRS will return your application without reviewing it.

- Make sure you’re applying for the right type of relief – The IRS is very strict with business taxes. Make sure you’re applying for a program that you’re likely to get approved for.

- Include accurate details – The IRS will double-check the details on the form with your supporting documents, as well as with public records in some cases.

- Be able to back up the fair market value of your assets – If the IRS thinks you’re undervaluing yoru assets, you may need to back up the FMV with sales comp numbers or other details.

- Avoid shutting down one business and opening up a similar one – The IRS looks for this type of behavior, especially in relation to unpaid payroll taxes, and you may get denied for relief if you’re shutting down and restarting businesses to avoid taxes.

Also, get help as needed – if you want to protect your business from the IRS and keep your doors open, you should consider working with an attorney.

FAQs on Form 433-B

Who should fill out Form 433-B?

Partnerships and corporations use these forms to apply for certin payment plans or relief optons. The IRS or a tax pro can let you know if you need to file these forms.

What is the difference between Form 433-A and Form 433-B?

Form 433-A is for individuals or sole proprietors. Form 433-B is for businesses. In some cases, you may need to fill out both forms.

When should I fill out these forms?

Fill out Form 433-B before applying for relief. If you have received a final intent to levy with your right to a hearing, make sure to file these forms or appeal by the deadline on the notice.

Where should I send Form 433-B?

There is no mailing address noted on this form. The revenue officer working your case or the ACS employee you reach on the phone can let you know where to send it.

How do I get Form 433-B?

You can download either of these forms from the IRS webpage or from the links at the top of this page – all public libraries allow you to print out free government forms. You can also call the IRS and ask to have these forms mailed to you.

Get Help With Business Back Taxes

Filling out Form 433-B and dealing with business back taxes can be complicated and frustrating. But you don’t have to deal with this on your own. The tax attorneys at the W Tax Group can help you file this form or explore other resolution options for your taxes owed.

Ready to get help and put this stress behind you? Then, contact us today. We’ll start with a no-obligation conversation, and then, we’ll help you find the best path forward for your situation.