IRS Letter LT1058: How to Appeal and Prevent Asset Seizure

IRS Letter LT1058 is a serious notice sent via certified mail that alerts you of the IRS’s plans to levy (seize) your property or rights to property. To protect your assets, you need to respond to this notice or take action within 30 days.

If you have questions or need assistance, the tax attorneys at The W Tax Group can help you respond to LT-1058 or similar notices like the LT-11. We are extremely experienced with these letters, and we help taxpayers resolve IRS tax liabilities every day. To learn more, contact us today.

Key Takeaways About IRS Letter LT1058

- LT-1058 – Final warning before the IRS seizes your assets for unpaid taxes.

- Deadline – You have 30 days to take action.

- Revenue officer assignment – This letter is typically sent by a Revenue Officer, meaning your case has already been escalated for more aggressive collection efforts.

- Options – Contact the IRS to set up payments or request relief options, or to appeal.

- How to appeal – You can request a Collection Due Process (CDP) hearing to appeal, but you must act within the 30-day window.

- What if you don’t respond? Ignoring IRS letter LT1058 can result in serious consequences, including asset seizure, wage garnishment, or loss of your passport.

Table of Contents

- Common Reasons Taxpayers Receive LT1058

- Difference Between LT11 and LT1058

- Deadline: How Long Do I Have to Respond?

- What to Expect When You’re Facing an IRS Levy

- How to Make a Payment to the IRS

- What If I Disagree with the Notice?

- How to Appeal With a Collection Due Process Hearing

- Collection Due Process Hearing: What to Expect

- What If I Can’t Afford to Pay in Full?

- IRS Payment Arrangement Options

- What If I Ignore IRS Letter LT1058?

- Get Help with LT1058 Today

Common Reasons Why People Receive LT1058

You received this letter because you have unpaid taxes, and you haven’t contacted the IRS to make payment arrangements. Now, the agency wants to forcibly collect the debt by taking your assets.

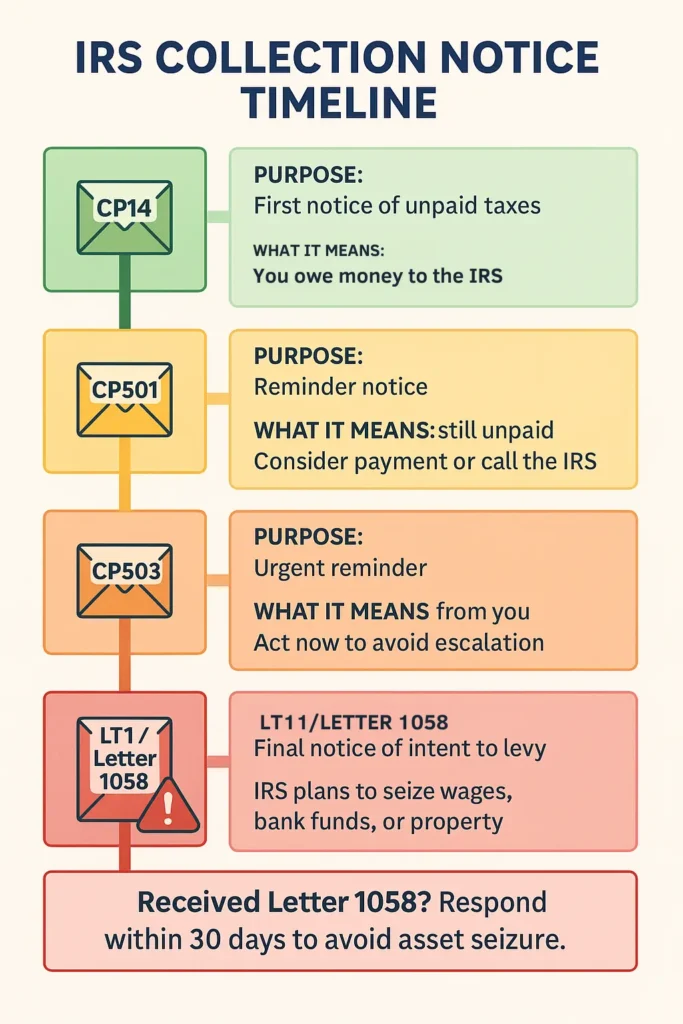

You may also receive this notice if you default on a payment arrangement. LT1058 is usually not the first letter the IRS sends. If earlier notices went unanswered (such as CP14, CP501, or CP504), this letter is the IRS’s final step before initiating a levy.

If you’ve received IRS Letter LT1058, know that you’re not alone. Many taxpayers face these challenges, and there are programs and professionals available to help you resolve the issue before it becomes more serious.

What’s the Difference Between LT11 and LT1058?

Both letters serve the same purpose: to inform you that the IRS intends to levy your assets if you don’t take action within 30 days. The difference lies in who sends them.

- LT11 is issued by the IRS Automated Collection System (ACS) when your case is still being handled at a national call center level.

- LT1058 comes from a local Revenue Officer once your case has been escalated for more serious enforcement.

If you’ve received letter LT1058, the IRS considers your case a higher priority and may be more aggressive in pursuing collection actions.

How Long Do I Have to Respond?

Generally, you have 30 days from the date of the letter to respond. It is critical you respond to the IRS by the deadline on the notice. If you ignore this notice and miss the deadline, you could be subject to levies or seizures of your property or rights to property, including the following assets:

- Wages and other income

- Bank accounts

- Social Security benefits

- State and federal tax refunds

- Other business or personal assets

The IRS can also alert the State Department. Then, you will not be able to get a new passport, and your current passport will be revoked. Interest and penalties will also accrue on your account.

What to Expect When You’re Facing a Levy

While receiving any notice from the IRS can be stressful, understanding how the levy process works can help you take informed action. The process usually begins with a Notice of Intent to Levy (IRS Letter LT1058 or LT11), which informs you that the IRS plans to seize your assets to cover unpaid taxes. From the date on the notice, you have 30 days to respond. This might include paying the debt, exploring alternative payment arrangements, or requesting a Collection Due Process (CDP) hearing.

If you request a CDP hearing in time, the IRS will temporarily halt collection efforts while an impartial appeals officer reviews your case. During the hearing (which is often just a phone call), you’ll have the chance to present documents, raise disputes about the debt, and discuss alternatives to levy, such as a payment plan or Offer in Compromise.

If you do not respond or if the hearing doesn’t result in a resolution, the IRS may proceed with levy action. This means they can legally take money from your wages or bank accounts, intercept your Social Security benefits, or seize physical assets.

Even if the IRS begins seizing assets, you’re not out of options. You may still be able to appeal the levy through the Office of Appeals or work directly with the IRS to resolve the debt. Acting quickly and understanding each step in the process can make a major difference in protecting your finances.

How to Make a Payment

To make full or partial payment of your tax liability, make your check or money order payable to the United States Treasury. The payment should be sent to the address at the top of the LT1058 notice. Make sure to write your Social Security Number or other taxpayer identification number on your payment. The amount due will appear at the bottom of the letter in a table.

If you only make a partial payment, that does not protect you from a levy – you still must contact the IRS to make arrangements on the remaining balance.

What If I Disagree with Notice LT1058?

If you disagree with the amount due or other details on Notice LT1058, you can file an appeal by requesting a Collection Due Process Hearing. This must be done within 30 days from the date of the notice.

Unfortunately, filing the appeal and responding to the IRS after it’s filed can be a daunting task. To increase your chance of having the IRS respond favorably to your appeal, you may want representation from a tax professional with experience in situations like these.

How to Request a Collection Due Process Hearing

If you’ve received IRS Letter LT1058, you have the right to request a CDP hearing to challenge the tax debt or the IRS’s intended collection actions. Here’s how the process works:

Step 1: Complete Form 12153

Form 12153 is titled “Request for a Collection Due Process or Equivalent Hearing.” It allows you to formally ask the IRS to review your case before a levy is carried out.

When completing the form, note that you received a final levy notice on line 1. Then, select your reason for appealing on line 8. Possible options include:

- You’re not liable for the tax

- You’re filing for bankruptcy

- You already paid the tax

- You’re applying for innocent spouse relief

- You can’t pay due to financial hardship

- You’d like a collection alternative (for example, you want to request payments)

There is also an “other” option where you can write in your own reason.

Step 2: Submit Form 12153

Mail or fax the completed form to the IRS office listed on your LT1058 notice. Make sure to submit it within 30 days of the date on your letter to retain full appeal rights and prevent immediate levy action. Keep a copy for your records and consider sending it via certified mail with return receipt for proof of timely filing.

Step 3: Prepare for the Hearing

Once the IRS receives your form, collection action is paused, and your case is transferred to the Office of Appeals. The hearing is usually conducted by phone.

What Happens at a Collection Due Process Hearing?

When you request a Collection Due Process (CDP) hearing, you’re asking the IRS to pause levy actions while you formally challenge either the tax debt itself or how the IRS plans to collect it. The hearing is typically conducted by phone with an impartial settlement officer from the IRS Office of Appeals, not the person who initially handled your case.

During the hearing, you’ll have the opportunity to:

- Dispute the amount owed, if you haven’t had the chance to do so before

- Propose alternatives to levy, such as an installment agreement or an Offer in Compromise

- Request innocent spouse relief, if applicable

- Raise concerns about IRS errors or procedural issues

You’ll need to provide supporting documents, such as financial statements like Form 433-A or 433-F, tax returns, or any other relevant paperwork. The settlement officer will review your case and either approve your proposed resolution or issue a determination letter explaining why the IRS will move forward with enforcement.

If you disagree with the outcome, you can appeal the decision to the U.S. Tax Court, giving you another chance to protect your assets.

What if I miss the deadline for a CDP hearing?

If you miss the deadline, you have up to one year from the levy notice to request an equivalent hearing with Form 12153. The equivalent hearing also lets you talk about payment alternatives, but you cannot dispute the tax liability itself.

Also, this request will not stop any in-progress levy actions, and if you disagree with the results of the hearing, you cannot appeal in Tax Court.

What If I Can’t Afford to Pay?

If you don’t have the money to pay, you may still be able to avoid liens, levies, or seizures by working out an arrangement with the IRS. This is an ideal opportunity to leverage the expertise of the tax attorneys at the W Tax Group. They can help you identify the best resolution option for your situation and negotiate the optimal arrangement with the IRS.

If you can’t pay the full amount, try to pay as much as you can. Whether you can make a partial payment or nothing at all, it’s important to contact the IRS. They may be willing to work with you to create a payment plan or find another solution based on what you can realistically afford.

Here are some of the potential payment options. Follow the links or contact us directly to learn more and to see if you may qualify for any of these programs.

- Installment Agreement: This allows you to make monthly payments until your tax liability is paid in full.

- Partial Pay Installment Agreement: If you cannot afford an IA, you may qualify for a partial payment IA. With this option, you may end up paying less than you owe.

- Offer in Compromise: This is an agreement between the IRS and qualifying taxpayers, where the IRS allows them to settle their tax bill for less than the full amount owed.

- Currently Non-Collectable: The IRS will not require you to pay your tax bill if it causes severe economic hardship. To get your account marked as currently not collectible, you need to prove to the IRS you cannot afford to pay both your living expenses and tax bill. Then, the IRS will reassess the situation every couple of years to see if anything has changed.

These tend to be the most popular IRS payment arrangements, but they are certainly not the only tax resolution options. When you contact us, we will discuss your situation with you and inform you about all the possible options tailored to your unique tax situation.

Can I Ignore IRS Notice LT1058?

Ignoring IRS Letter LT1058 would be a bad idea. This letter is not a warning to take lightly. It’s a final notice before the IRS begins seizing your assets. If you don’t respond within 30 days, the IRS can move forward with levying your wages, bank accounts, property, Social Security benefits, and even your tax refunds.

In some cases, they may also notify the State Department, which can restrict or revoke your passport. Interest and penalties will continue to accumulate, and your financial situation may become increasingly difficult to resolve.

The good news is, you still have options, but only if you act quickly. Whether you agree with the debt or want to challenge it, responding to the notice gives you a chance to protect your income and assets and work out a resolution.

Get Help with LT1058 Today

For assistance, please contact The W Tax Group to speak with our team of experienced tax attorneys regarding this letter or any other tax-related issues. During your free tax case review, we can evaluate your situation and help you determine your next best steps. You can call us directly at (877) 500-4930